Note: After one of the most contentious legislative sessions I’ve witnessed, legislators adjourned the regular session early this morning. For the first time, the state budget includes $100,000 for homeless pregnant mothers to receive shelter and other services for up to a year with their baby. The measure prohibits any of the funding going to abortion referrals or abortion providers. We’re grateful to Rep. David Livingston for securing this funding!

Regretfully, however, this is the first legislative session in many years to not expand school choice opportunities. Read on for the facts about school choice.

A near-constant refrain for the last few months alleges that Arizona’s scholarship tax credits are largely to blame for inadequate teacher pay and underfunded public schools. The public policy debate ignores the facts in order to cast private schools as the villains robbing the public schools. Not so.

Fact: school choice actually saves taxpayer money.

At Center for Arizona Policy (CAP), we support enabling parents to choose the education they deem best for their children, whether that choice is public, private, charter, online, or homeschool. That is why CAP generally supports increasing public school funding and teacher pay, but also supports expanding school choice options. We supported Proposition 123 to allocate more dollars to public schools. In the recently concluded legislative session, we sent legislators a letter supporting increased teacher pay and increased funding.

School choice is not only good for parents and their children, but also for taxpayers.

For example, with each child homeschooled in Arizona, taxpayers save thousands of dollars. It is estimated that there are around 35,000 homeschool students in Arizona, saving taxpayers millions of dollars a year that would otherwise have to be spent on their education. These taxpayer savings apply equally to the thousands of students in private schools in Arizona that do not receive any tax credit scholarship or Empowerment Scholarship Account.

However, taxpayers savings even extend to students that do receive tax credit scholarships through a School Tuition Organization (STO).

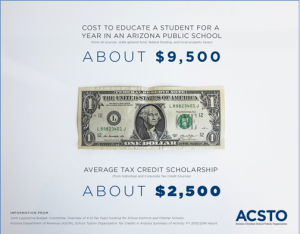

A recent Facebook post from Arizona Christian Tuition Organization (ACSTO) highlighted how STOs save taxpayers around $7,000 per student per year:

“Did you know the average cost to taxpayers for each student enrolled in a public school is about $9500 per year from all sources (state general fund, federal funding, and local property taxes)? This information comes from the Joint Legislative Budget Committee.

According to the most recent Arizona Department of Revenue (ADOR), School Tuition Organization Tax Credits in Arizona Summary of Activity:

- 352 Private Schools receive tax credit scholarships

- The Average Original Tax Credit Scholarship – $1,724.00

- The Average Overflow Tax Credit Scholarship – $1,360.00

- The Average Low-Income Tax Credit Scholarship – $2,165.00

The average scholarship from individual and corporate scholarship tax credit sources is roughly $2500 per student. Keep in mind that not every student enrolled in a private school qualifies for all four Private School Tax Credit programs. All but the Original Tax Credit Scholarship have distinct qualifications that must be met.

The average $2500 scholarship is far less than what the public schools receive ($9500) on a per student basis in funding. This is saving the taxpayer at the expense of parents with children in private schools. This results in a $7000 savings to the taxpayer.”

ICYMI – Latest News & Articles of Interest

- “Which side in America’s great cultural conflict is winning – is it the right, or is it the left?” by Albert Mohler

- “Alfie Evans, UK toddler at center of legal battle, dies” from Fox News

- “Life in the Balance in Liverpool — Alfie Evans Is Not Alone” by Albert Mohler

- “Amazon Boots Christian Nonprofit From Donations Program Because Of SPLC’s ‘Hate List’” from The Federalist

Stay connected and consider receiving additional publications by joining the CAP Network.